Social Security COLA 2024 Details are following…

Table of Contents

Social Security cost-of-living adjustment will be 3.2% in 2024, well below this year’s record-setting increase

Take Away Points or Key Points

- More than 71 million Americans will see a 3.2% increase to their Social Security and Supplemental Security Income benefits in 2024, the Social Security Administration announced on Thursday.

- Social Security retirement benefits will increase by more than $50 per month on average.

- The adjustment is far lower than the 8.7% benefit boost for 2023.

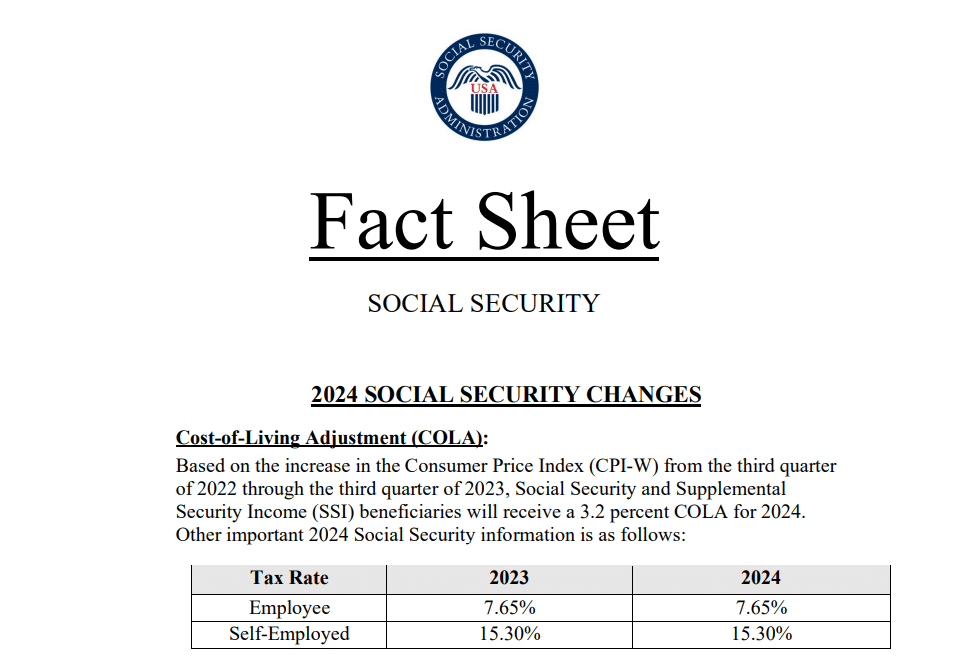

Get PDF | Social Security Changes – COLA Fact Sheet | Cost-of-Living Adjustment (COLA) Information for 2024

Read more about the Social Security Cost-of-Living adjustment for 2024.

How much retirees can expect

The change will result in an estimated Social Security retirement benefit increase of $50 per month, on average. The average monthly retirement benefit for workers will be $1,907, up from $1,848 this year, according to the Social Security Administration.

Most Social Security beneficiaries will see the increase in their monthly checks starting in January. SSI beneficiaries will see the increase in their December checks.

Just how much of an increase retired beneficiaries will see in their Social Security checks will also depend on the size of the Medicare Part B premium for 2024, which has not yet been announced.

Typically, Medicare Part B premium payments are deducted from Social Security checks. The Medicare trustees have projected the average monthly premium may be $174.80 in 2024, up from $164.90 in 2023.

Social Security COLA 2024 Medicare Information

Information about Medicare changes for 2024 will be available at www.medicare.gov. For Social Security beneficiaries receiving Medicare, their new 2024 benefit amount will be available in December through the mailed COLA notice and my Social Security’s Message Center.

Lucid stock price prediction 2025, 2030, 2035, 2040, 2050

Social Security COLA 2024 Your COLA Notice

In December 2023, Social Security COLA notices will be available online to most beneficiaries in the Message Center of their my Social Security account.

This is a secure, convenient way to receive COLA notices online and save the message for later. You can also opt out of receiving notices by mail that are available online. Be sure to choose your preferred way to receive courtesy notifications so you won’t miss your secure, convenient online COLA notice.

Eyeing on $1.55 billion the Powerball jackpot? Here’s what you’d pocket after taxes.

How the 2024 COLA compares ?

The 2024 benefit increase is much lower than record 8.7% cost-of-living adjustment Social Security beneficiaries saw this year, the biggest boost in four decades in response to record high inflation. It is also lower than the 5.9% cost-of-living adjustment for 2022.

The average cost-of-living adjustment has been 2.6% over the past 20 years, according to The Senior Citizens League, a nonpartisan senior group.

Source: Social Security Administration

The 3.2% increase is in line with an estimate released by The Senior Citizens League last month.

The Social Security cost-of-living adjustment is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W. Data from the third quarter is added and averaged and then compared with the third quarter average from the previous year. If there is an increase, that determines the size of the COLA.

Unveiling the Depth of Investment Management: Beyond Stock Transactions

Older Americans ‘still feeling the sting’ of inflation

The 2024 adjustment comes as many retirees are still struggling with higher prices.

“Retirees can rest a little easier at night knowing they will soon receive an increase in their Social Security checks to help them keep up with rising prices,” AARP Chief Executive Jo Ann Jenkins said in a statement.

Will 3.2% Social Security 2024 COLA be enough to help seniors recover from inflation?

◾ Inflation: 68% of older adults say their household expenses remain at least 10% higher than one year ago, although the overall inflation rate has slowed, according to the League’s survey. They said this situation has persisted over the last year.

Bullish on the U.S. Stock Market: Top Shares to Watch in the Coming Years

◾ Benefit cuts: Nearly 6 out of 10 respondents rank this as their top worry. “Significant numbers of lower-income older households have lost access to some safety net programs over the past 12 months,” Johnson said.

Senior citizens will see a much smaller Social Security boost for 2024

Social Security recipients will receive an annual cost-of-living adjustment of 3.2% for 2024, a much smaller increase than the inflation-fueled boosts of the past two years, the Social Security Administration announced Thursday.

Maximize Your Returns: The Power of Structured Portfolio Management 2023, 2024, 2030, 2050…

Retirees’ monthly payments will rise by $59 to an estimated average of $1,907, starting in January.

The lower adjustment reflects the fact that inflation has moderated this year. Recipients had received increases of 8.7% for 2023 and 5.9% for last year, which were the largest since the early 1980s.

“It’s a small amount, but it’s providing some cushion,” said Mary Johnson, Social Security policy analyst at The Senior Citizens League, an advocacy group. “We have the hope that things are going to be more affordable.”

The boost remains well above the average over the past two decades, which is 2.6%, she said. The annual adjustment is based on an inflation metric from August through October, which has cooled after being around four-decade highs a year ago.

A related metric, the Consumer Price Index, increased 3.7% in September, compared with a year ago, the Bureau of Labor Statistics announced Thursday.

What is the maximum Social Security benefit for 2024?

The maximum benefit for a high-income single worker claiming Social Security at “full” retirement age will be $3,822 a month in 2024, up from a maximum of $3,627 in 2023.

How do I get the $16728 Social Security bonus?

Have you heard about the Social Security $16,728 yearly bonus? There’s really no “bonus” that retirees can collect. The Social Security Administration (SSA) uses a specific formula based on your lifetime earnings to determine your benefit amount.

How much will my Social Security check be in 2023?

Average SSDI payments by state

| State | Average monthly SSDI payment |

|---|---|

| California | $1,395.93 |

| Colorado | $1,374.74 |

| Connecticut | $1,416.96 |

| Delaware | $1,462.23 |

At what age is Social Security no longer taxed?

Social Security benefits may or may not be taxed after 62, depending in large part on other income earned. Those only receiving Social Security benefits do not have to pay federal income taxes. If receiving other income, you must compare your income to the IRS threshold to determine if your benefits are taxable.

Can you live on Social Security alone?

If you’re approaching retirement having saved less than you’d like, you could possibly live on Social Security alone, you’ll need a game plan to make it work. Here’s what you need to know to create a retirement budget that can help you meet your necessary living expenses using only Social Security income.

Can a citizen who never worked get Social Security?

But even if you never worked and therefore don’t have an earnings record, you’re not necessarily out of luck. If you’re married (or were married) to someone who’s entitled to Social Security, you can collect spousal benefits equal to 50% of your husband or wife’s benefits at full retirement age.

Average SSDI benefit amounts by state

| Rank | State | Average monthly SSDI benefit |

|---|---|---|

| 1 | New Jersey | $1,505.33 |

| 2 | Delaware | $1,462.23 |

| 3 | Nevada | $1,430.04 |

| 4 | Connecticut | $1,416.96 |

| 5 | Arizona | $1,414.45 |

| 6 | Maryland | $1,413.31 |

| 7 | New York | $1,407.15 |

| 8 | New Hampshire | $1,400.88 |

| 9 | Hawaii | $1,399.88 |

| 10 | California | $1,395.93 |

| 11 | Florida | $1,391.59 |

| 12 | South Carolina | $1,387.31 |

| 13 | Michigan | $1,384.77 |

| 14 | Colorado | $1,374.74 |

| 15 | Illinois | $1,372.64 |

| 16 | Washington | $1,371.51 |

| 17 | Virginia | $1,371.15 |

| 18 | Massachusetts | $1,366.75 |

| 19 | Pennsylvania | $1,365.92 |

| 20 | Wyoming | $1,365.71 |

| 21 | Georgia | $1,361.26 |

| 22 | North Carolina | $1,359.17 |

| 23 | Indiana | $1,355.25 |

| 24 | Utah | $1,351.22 |

| 25 | Minnesota | $1,350.71 |

| 26 | Alaska | $1,348.58 |

| 27 | West Virginia | $1,344.70 |

| 28 | Texas | $1,341.37 |

| 29 | Wisconsin | $1,340.21 |

| 30 | Oregon | $1,338.75 |

| 31 | Rhode Island | $1,338.57 |

| 32 | Idaho | $1,334.02 |

| 33 | Alabama | $1,333.89 |

| 34 | Tennessee | $1,325.22 |

| 35 | Kentucky | $1,322.16 |

| 36 | Kansas | $1,321.28 |

| 37 | Missouri | $1,319.28 |

| 38 | Ohio | $1,303.69 |

| 39 | Oklahoma | $1,303.18 |

| 40 | Louisiana | $1,300.18 |

| 41 | Mississippi | $1,297.66 |

| 42 | Arkansas | $1,294.57 |

| 43 | Iowa | $1,291.55 |

| 44 | Montana | $1,287.91 |

| 45 | New Mexico | $1,280.54 |

| 46 | Vermont | $1,279.63 |

| 47 | Maine | $1,274.98 |

| 48 | Nebraska | $1,274.63 |

| 49 | North Dakota | $1,269.30 |

| 50 | South Dakota | $1,265.47 |

| 51 | District of Columbia | $1,209.39 |

2 thoughts on “Social Security COLA 2024 : Big Cost-of-Living Adjustment (COLA) Information for 2024”