Table of Contents

New Interest Rate Regime | The financial landscape is undergoing a transformation, as a new era of interest rates unfolds. Investors, both seasoned and novice, are keenly observing the shifting dynamics in the market. This article delves into the implications of this changing interest-rate regime on various sectors, without relying on trendy buzzwords.

Winners | New Interest Rate Regime

- Financial Institutions: Financial institutions, including banks and credit unions, often thrive in rising interest-rate environments. Higher rates can lead to increased profitability through lending and investment activities. These institutions stand to benefit as they can offer more attractive savings and investment products to consumers.

- Value Stocks: In a changing rate environment, value stocks tend to shine. These stocks represent companies with strong fundamentals, trading at a discount relative to their intrinsic value. Rising interest rates can make these stocks more appealing to investors seeking stability and growth potential over the long term.

- Consumer Discretionary: The consumer discretionary sector can also emerge as a winner. Historically, as the economy strengthens alongside rising interest rates, consumers tend to have more disposable income. This can lead to increased spending on non-essential items, benefiting companies in this sector.

- Commodities: Commodities often serve as a hedge against inflation, which can be a consequence of higher interest rates. Investors may consider diversifying their portfolios by including commodities like gold, silver, and oil to counteract the effects of inflation.

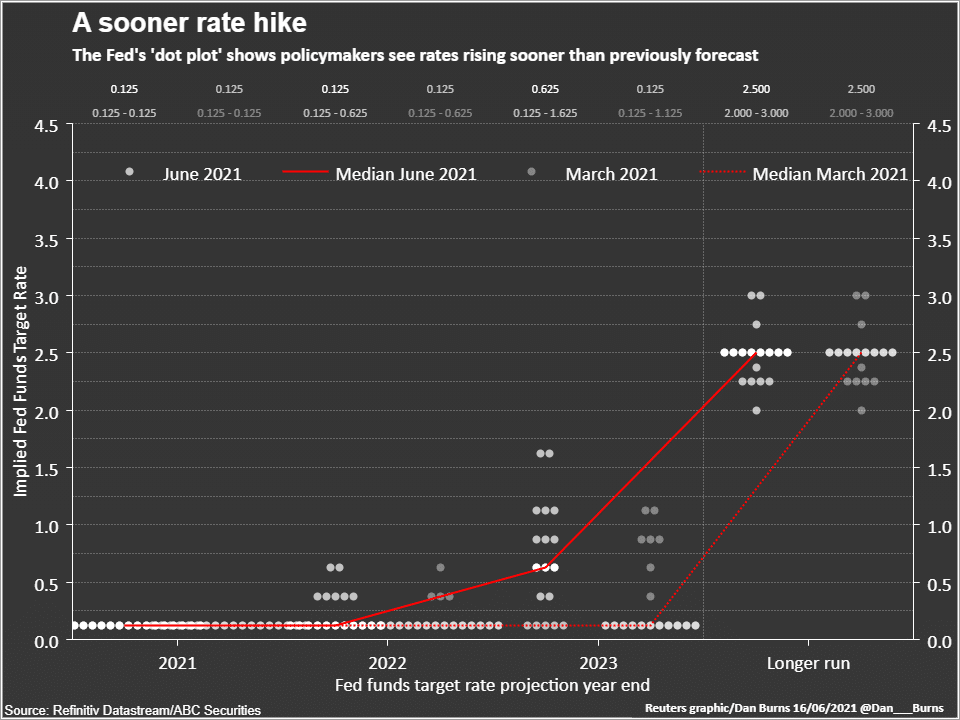

Interest Rates Likely to Return Toward Pre-Pandemic Levels When Inflation is Tamed

Losers | New Interest Rate Regime

- Utilities: Typically, the utility sector faces headwinds in a rising rate environment. Utilities often carry high levels of debt, and higher interest rates can increase their borrowing costs, potentially squeezing profit margins. Investors may reconsider their exposure to this sector in the new rate regime.

- High Dividend Stocks: High dividend stocks may lose some appeal as interest rates rise. Investors seeking income often turn to dividend-paying stocks, but when interest rates climb, fixed-income investments may become more attractive, potentially causing a shift away from high dividend equities.

- Real Estate Investment Trusts (REITs): REITs often underperform in a rising rate environment due to their sensitivity to borrowing costs. As interest rates increase, the cost of financing real estate holdings for REITs rises, which can negatively impact their profitability.

- Long-Duration Bonds: Investors holding long-duration bonds may experience price declines when interest rates rise. This is because newly issued bonds at higher rates become more attractive, reducing the appeal of existing bonds with lower yields.

Bullish on the U.S. Stock Market: Top Shares to Watch in the Coming Years

Conclusion:

As a new interest-rate regime takes shape, investors should be mindful of the sectors that tend to thrive and those that may face challenges. Diversification, as always, remains a prudent strategy to navigate these changing market dynamics. Rather than relying on buzzwords, investors should focus on understanding the fundamentals of the assets they hold and make informed decisions to align with their long-term financial goals. It’s a reminder that markets are dynamic, and adapting to changing conditions is key to successful investing.

Fed’s Williams Says Policy in Good Place, Must Be Data Dependent

4 thoughts on “A Shift in New Interest Rate Regime : Unveils Market Winners and Losers in United States 2023”