Table of Contents

Early Stage Investment: Investing money in early-stage ventures can be a rewarding yet challenging endeavor. The allure of high returns often overshadows the risks involved. To make informed decisions, it’s crucial to navigate the financial landscape carefully. In this article, we’ll explore some prudent strategies for investing in early-stage companies while avoiding buzzwords and focusing on sound financial principles.

Diversify Your Portfolio in Early Stage Investment

A fundamental tenet of investment strategy involves diversification. Early-stage investments come with a high level of risk, so spreading your investments across different sectors and stages can help mitigate potential losses. Diversification mitigates the influence of a single investment’s underperformance on your entire portfolio.

Conduct Thorough Due Diligence

Avoid falling into the trap of buzzwords and hype. Conduct extensive due diligence before investing in any early-stage company. Scrutinize the business model, management team, financials, and market potential. Look for tangible evidence of traction and scalability rather than relying on trendy catchphrases.

Understand the Market and Industry in Early Stage Investment

Investing in early-stage ventures often involves niche markets or emerging industries. Take the time to understand the dynamics of the market and industry in which the company operates. Look beyond buzzwords like “disruption” and delve into the specifics of how the business plans to address market needs.

The Future of Cryptocurrency: Top Contenders for the Next Big Thing

In Early Stage Investment you need to assess the Management Team

The people behind a startup are often more critical than the idea itself. Assess the experience, track record, and commitment of the management team. Look for evidence of their ability to execute the business plan and adapt to changing circumstances.

Long-Term Perspective

Avoid chasing short-term gains. Early-stage investments are typically illiquid, and it may take years for a company to mature or provide a return on your investment. Be prepared for the long haul and resist the urge to make impulsive decisions based on market noise.

Bullish on the U.S. Stock Market: Top Shares to Watch in the Coming Years

Invest What You Can Afford to Lose

Early-stage investments are inherently risky, and there is a significant chance of losing your entire investment. Only invest money you can afford to lose without compromising your financial well-being or long-term goals.

Stay Informed and Updated

To make informed decisions, stay updated on the progress of your investments. Attend shareholder meetings, read quarterly reports, and keep an eye on industry news. Avoid making investment decisions solely based on buzzworthy news or social media hype.

Consider the Exit Strategy

Before investing, understand the potential exit strategies for your investment. These could include acquisition by a larger company, an initial public offering (IPO), or even a merger. Having a clear exit strategy can help you plan for the future and manage your expectations.

Evaluate Funding Rounds

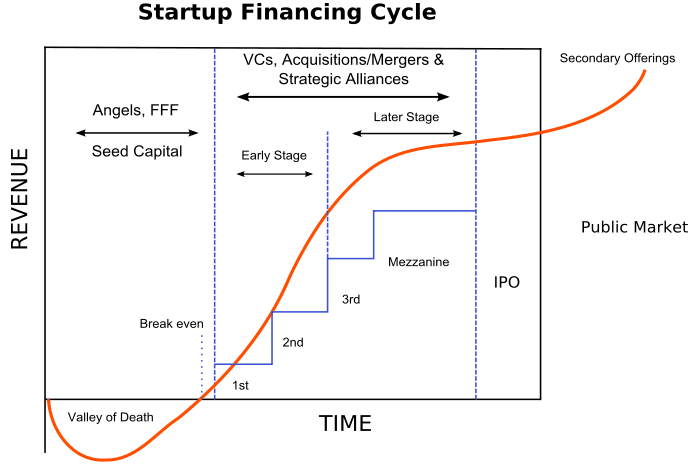

Early-stage companies often go through multiple funding rounds. Consider the stage at which you are entering. Pre-seed and seed rounds are riskier but offer higher growth potential, while later-stage rounds may provide more stability but potentially lower returns.

Seek Professional Advice

If you are not well-versed in early-stage investments, consider seeking advice from financial professionals or consultants. They can help you navigate the complex world of startups and provide insights that go beyond buzzwords.

Conclusion

Investing in early-stage companies can be a lucrative way to grow your wealth, but it’s not without its risks. Avoid getting caught up in buzzwords and hype. Instead, focus on sound financial principles, diversify your portfolio, conduct thorough due diligence, and maintain a long-term perspective.

Remember that early stage investments are a high-risk, high-reward game. By following these strategies and staying informed, you can increase your chances of success while minimizing potential losses. Always approach early-stage investments with caution, and never invest money you cannot afford to lose.

Early Stage Investment | Early Stage Investment in Stock

4 thoughts on “Smart Strategies for Early Stage Investment: A Financial Guide Part 1”